Timelines extended by CBDT for issuance of Notice and order under section 73 and 74 of GST Act.

Section 73 pertains to the determination of tax liabilities such as unpaid or underpaid taxes, erroneously refunded amounts, or wrongly claimed input tax credits, excluding cases of fraud or willful misstatement.

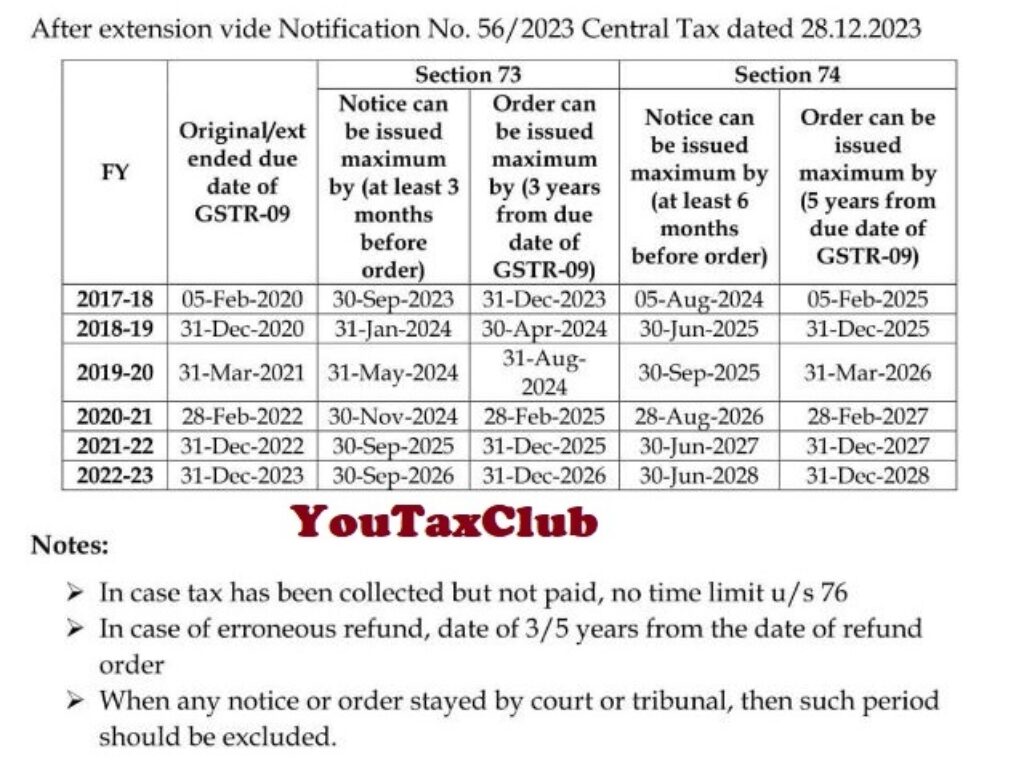

Through Notification No. 56/2023 – Central Tax, dated December 28, 2013, the CBIC has extended the deadlines for issuing notices and orders under Section 73 of the CGST Act for the FY 2018-19 and 2019-20.

While the notification specifies the time limit for passing orders, it does not include the deadline for issuing notices. However, as per Section 73(2) of the CGST Act, the proper officer is mandated to issue notices at least three months before the deadline for order issuance. Therefore, the deadline for issuing Show Cause Notices (SCNs) aligns precisely three months prior to the order deadline.

Issuing Orders under Section 73(9) of the CGST Act, 2017

This subsection of Section 73 delineates the process for determining demands and issuing orders to ascertain the tax, interest, and penalties owed. However, such orders must be issued after duly considering any representations made. As per the principles of natural justice, a taxable person should be granted an opportunity for a personal hearing before an order is issued. However, no such opportunity needs to be provided before issuance of show cause notice

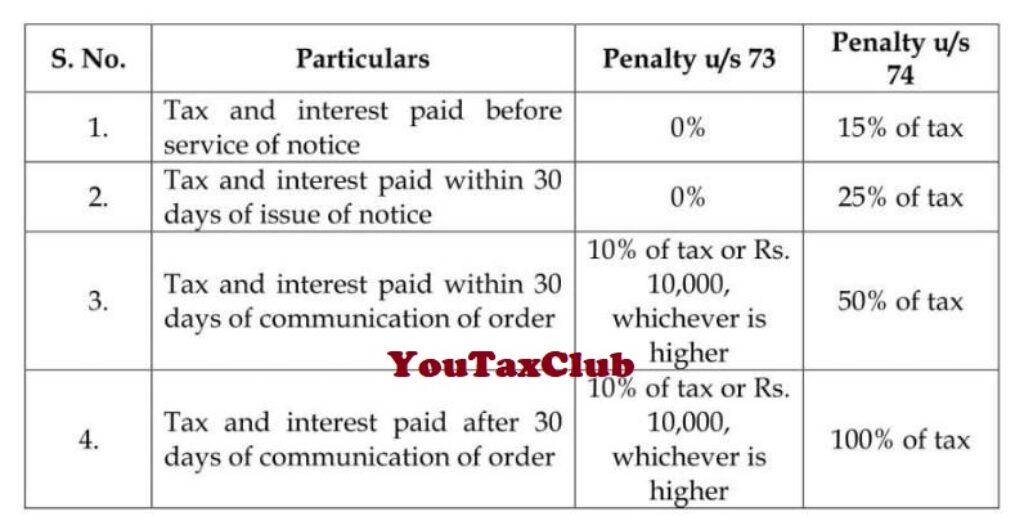

Under Section 73(9) of the CGST Act, 2017, if a show cause notice is issued, the proper officer can levy a penalty up to 10% of the tax due or INR 10,000/-, whichever is higher. Upon receiving a reply or representation, the proper officer, after due consideration, shall issue an order detailing the tax, interest, and penalty (i.e., tax + interest + penalty). The penalty amount will be the higher of 10% of the tax due or Rs. 10,000/-.

A summary of such an order shall be electronically uploaded, specifying the tax, interest, and penalty payable by the taxpayer. This summary serves as a notice for recovery.

Regarding the time limit for scrutinizing GST returns for the financial years 2017-18, 2018-19, and 2019-20, it’s noted that the entire scrutiny process under Section 61 and Rule 99 of the GST Act/Rules typically takes around 5 to 6 months. Therefore, all field formations/proper officers were advised to ensure timely issuance of orders under Section 73(9) for return scrutiny for the mentioned periods, as per CBIC Notification No. 9/2023 Central Tax dated 31.03.2023 (further extended by Notification No. 56/2023-CT dated 28.12.2023).

Time Limits for Orders under Section 73(10) of the CGST Act, 2017

As per subsection (3), the proper officer must issue an order within 3 years from the due date for filing the Annual return for the relevant year or the date of erroneous refund, whichever is earlier. Proceedings initiated under Section 73 demand conclusion within 3 years from the due date of filing the annual return or the actual filing date, whichever is earlier. If no order is issued within the prescribed 3-year period from the filing date of the annual return, the proceedings terminate due to the expiration of the limitation period. Any order issued after this 3-year limit is considered defective and therefore ineffective.

Extended Time Limits

The Central Government, through Notification No. 9/2023 Central Tax dated 31.03.2023, and Notification No. 56/2023-CT dated 28.12.2023, extended the time limits for issuing show cause notices and adjudication orders under Section 73 of the CGST Act. Notification No. 9/2023 Central Tax dated 31.03.2023 extended the time limit specified under Section 73(10) for issuing orders under Section 73(9) of the CGST Act, 2017, for the recovery of unpaid or underpaid taxes or wrongly availed input tax credits for reasons other than fraud, willful misstatement, or tax evasion.

Summery of Extended Timelines for issuance of Notice and order under section 73 and 74 of GST Act.

Summery of quantum of penalties under section 73 and 74 of GST Act.

Our Other Post

GST Appeal: Filing procedure & Physical document submission#

Thanks for this valuable information.